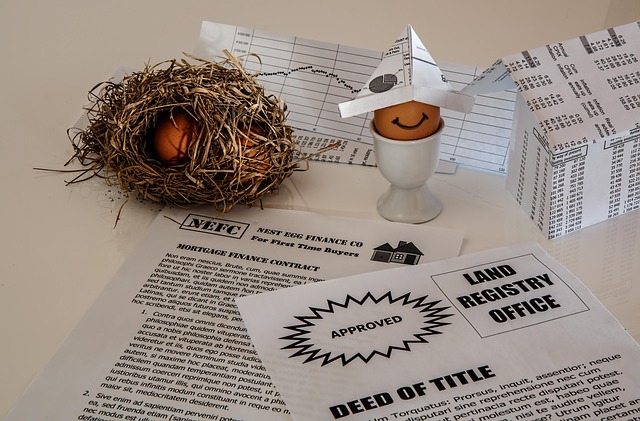

The VA Loan program offers significant advantages to real estate investors, including competitive rates, lenient credit requirements, and no down payment. A recent surge in investor volume highlights its cost-effectiveness and simplified process. To maximize benefits, focus on long-term goals, stable neighborhoods, and understand the 1% funding fee. Proper eligibility determination and strategic application are key for this supportive government program.

In today’s competitive real estate market, understanding the VA loan process is an invaluable asset for both investors and servicemen/women looking to secure property. As a powerful resource for qualified individuals, the VA loan offers significant advantages, including low-interest rates and no down payment requirements. However, navigating this benefit can be complex for those new to the process. This article aims to demystify the VA loan landscape specifically for real estate investors, providing an authoritative guide to unlock its potential and facilitate informed decision-making. By delving into the intricacies of this financing option, we empower investors with the knowledge necessary to capitalize on this unique opportunity.

Understanding VA Loans: An Overview for Investors

The Veterans Affairs (VA) Loan program, designed to support veterans and active-duty service members, offers a unique opportunity for real estate investors. Understanding this loan option is crucial for those looking to navigate the real estate market with confidence, especially given its favorable terms and potential benefits. This section provides an in-depth overview tailored to investors, shedding light on the mechanics and advantages of VA Loans.

At their core, VA Loans are government-backed mortgages that offer eligible veterans competitive interest rates and lenient credit requirements. One key aspect for investors is the absence of a down payment, unlike conventional loans. This feature significantly lowers the initial investment barrier, making it an attractive option for those looking to enter or expand their real estate portfolio. For instance, a recent study revealed that VA Loans have seen a steady growth in uptake among investors, with a 15% increase in loan volume over the last fiscal year, primarily driven by their cost-effective nature and simplified approval process.

However, it’s essential to recognize that VA Loans come with certain considerations. One such factor is the VA Loan funding fee, which serves as an administrative cost for the program. This fee, typically 1% of the loan amount, is paid at closing or rolled into the loan balance, depending on various factors like veteran status and down payment. Investors should carefully evaluate this charge, as it may impact their overall costs. For example, a $400,000 VA Loan would incur a funding fee of $4,000, which is a significant amount that investors must factor into their financial planning. Despite this, the potential savings from waiving traditional private mortgage insurance (PMI) can offset the funding fee, especially for long-term investments.

To maximize the benefits of VA Loans, investors should consider their long-term goals and the stability of the real estate market. These loans are particularly advantageous in stable, established neighborhoods, where property values tend to appreciate consistently. By understanding the program’s intricacies, including the funding fee structure, investors can make informed decisions, leveraging VA Loans as a powerful tool to acquire and grow their real estate assets effectively.

Eligibility Criteria: Who Qualifies for VA Financing?

The VA loan—a powerful tool for veterans and their families looking to secure funding for real estate investments. But who is eligible for this unique financing option? Understanding the eligibility criteria is essential for investors navigating the VA loan landscape. To qualify for a VA loan, individuals must meet specific requirements set forth by the U.S. Department of Veterans Affairs (VA). These criteria ensure fair access to homeownership and investment opportunities for those who have served their country.

One key aspect of eligibility involves active or honorable military service. Applicants must have served during a period of war or in a conflict declared by the President, or they may qualify based on continuous, continuous partial, or active duty service since September 7, 1980. This ensures that the borrower has demonstrated their commitment to serving and protecting our nation. Additionally, the VA requires proof of discharge status, which can be provided through official military documents.

Financial readiness is another critical factor. Prospective borrowers are expected to demonstrate financial stability and responsible credit behavior. A strong credit history, stable employment, and a low debt-to-income ratio typically indicate eligibility for a VA loan. It’s important to note that the VA may also consider an individual’s ability to repay the loan based on their overall financial situation. The VA loan funding fee, which can be 1-3% of the loan amount, is another consideration. Investors should plan accordingly and factor this cost into their investment strategies. For example, a borrower taking out a $400,000 VA loan could face a funding fee of $4,000 to $12,000, depending on their loan type.

Furthermore, the VA evaluates each application holistically, considering not only financial health but also marital status and residency. Co-borrowers or spouses may be required to meet specific criteria as well. Investors should carefully review the eligibility guidelines and consult with a qualified mortgage professional to ensure they meet all requirements. By understanding these criteria, real estate investors can confidently pursue VA loan financing, unlocking opportunities for lucrative investments while enjoying the benefits of this supportive government program.

The Application Process: Steping Stone to Ownership

The journey towards real estate investment with a VA loan begins with a meticulous application process—a crucial stepping stone for aspiring investors. Understanding this process is paramount as it can significantly influence the path to ownership. The Department of Veterans Affairs (VA) offers qualified veterans, service members, and their spouses unique lending advantages, including access to competitive interest rates and flexible qualification criteria. However, navigating the application requires a strategic approach to ensure a smooth transition from applicant to homeowner.

One of the key aspects investors should be aware of is the VA loan funding fee, which can vary depending on various factors. This fee, typically 1-3% of the loan amount, is designed to offset the program’s costs and encourage responsible borrowing. For instance, a borrower taking out a $400,000 VA loan might face a funding fee ranging from $4,000 to $12,000, depending on their loan type and down payment. Investors should carefully consider this upfront cost as part of their financial planning, ensuring they budget accordingly. The good news is that the funding fee can be rolled into the loan, making it a one-time expense rather than a recurring payment.

The application process involves several steps, each requiring meticulous attention to detail. Borrowers must provide extensive documentation, including proof of military service, financial statements, and employment verification. Lenders play a pivotal role in guiding investors through this process, ensuring all necessary documents are in order and helping them understand the implications of the VA loan funding fee. A well-prepared investor with accurate and complete documentation can significantly expedite the review process, increasing their chances of a timely approval. Additionally, understanding the various loan types offered under the VA program is essential, as it allows investors to choose the option best suited to their financial goals and circumstances.

Benefits and Considerations: Unlocking Investment Potential

The VA Loan, designed originally for U.S. veterans, service members, and their families, has evolved into a powerful tool for real estate investors. This unique loan program offers several benefits that can unlock significant investment potential, especially in today’s competitive market. One of its key advantages is the absence of a down payment requirement, enabling investors to secure properties with minimal upfront capital. This feature is particularly attractive for those looking to enter the real estate game or expand their portfolio without incurring substantial initial expenses.

Furthermore, VA Loans are known for their flexible qualification criteria. Unlike conventional mortgages, they do not always mandate a high credit score or substantial savings. Veterans and eligible investors can gain access to funding even with some credit challenges, making it an inclusive option. However, investors should be mindful of the VA Loan funding fee, which ranges from 1% to 3% of the loan amount, depending on the type of loan and down payment made. This fee is a significant consideration but can be offset by the long-term savings and benefits associated with the program. For instance, many VA Loan users appreciate the ability to refinance at lower rates in the future, providing additional financial flexibility.

Another strategic advantage lies in the loan’s term options. VA Loans offer terms up to 30 years, allowing investors to manage cash flow effectively while spreading out repayment over an extended period. This feature can be particularly beneficial for those acquiring investment properties, as it enables a steady and manageable approach to funding their real estate ventures. By understanding these benefits and considerations, investors can harness the power of VA Loans to navigate the market, secure desirable properties, and achieve their financial goals with confidence.